If you have ever wondered why real estate may be a good place to invest, look at what is going on in the markets today. The Dow Jones is heading south due to the impact of coronavirus spreading globally, causing both individuals and companies to change their travel and spending.

The stocks have reacted with the worst decline since 2009. Over 95% of stocks have reduced by more than 10% of their highs. As more investors and pre-programmed machines sell their stocks, the uncertainty will continue to rock the stock markets. My hope is this trend will stop quickly to contain the coronavirus for obvious health reasons, but also to maintain retirement accounts and wealth for those planning to need their investments in the short term.

Last week the Federal Reserve announced the first emergency rate cut since 2008. The rate cut is concerning for the markets but beneficial to real estate investors due to lower interest rates on mortgages. The lower the rate the higher potential returns for the real estate investment due to reduced debt service payments. As long as investors leverage debt conservatively, and work through detailed due diligence on their potential asset, the risk to lose returns on the investment will remain much less in multi-family.

What I like about multi-family investments, especially Class B and C attainable housing, is people need a place to live. Even if people move in with each other and start downsizing, apartments satisfy one of Maslow’s Hierarchy of Needs…safety through shelter.

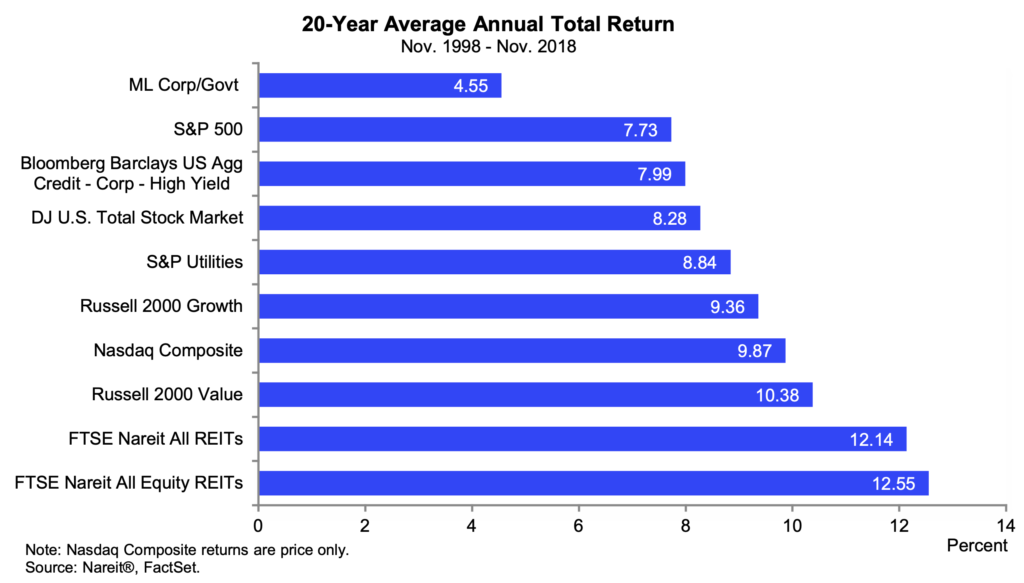

Real Estate is dependent on supply and demand and influenced by the market cycle (recovery, expansion, hyper-supply, and recession cycles). The ideal situation is to diversify and not invest your entire savings to one investment. However, when comparing different investment classes over a period of time, multi-family and other commercial real estate assets in general have been solid performers despite economic downturns as shown in the chart below.

There are several reasons why investors seek multi-family investments in their portfolio, to include the following:

- Return on Investment

- Risk Resilience

- Leverage

- Tax Advantages

- Market Demand

- Appreciation and Amortization

Stay tuned for future blogs on these 6 reasons to invest in multi-family and for more information on market cycles.

If you are interested in learning more about passively investing with CREI Partners let’s start by building a relationship. Click here to schedule a time to connect.

Subscribe to our newsletter so you never miss out on new investment opportunities, podcasts, blogs, news and events.

Subscribe to our newsletter so you never miss out on new investment opportunities, podcasts, blogs, news and events.